What is A Closing Disclosure and Why Is It Important?

Let’s dig a little into a document that will be presented to both the seller and the buyer in a real estate selling/buying transaction. Also, if you are refinancing your home. So what is the CD and why I should be put some attention to it? Well, the CD is a document or a form that is issued at the end of the process. Typically 3 days before the closing. This form will have the final numbers of your loan (for the buyer), fees, interest rates, mortgage closing costs, etc. In other words, the grand total of all payments and finances charges. Sellers will also receive a closing disclosure with all the fees. However, it will be an abbreviated version of the buyer’s version. It shows the seller’s portion of the fees associated with the transaction, including the mortgage payoff amount and anything the seller has agreed or negotiate it during the transaction.

How the Closing Disclosure looks like:

On the first page, you will find the borrower’s information and address and the loan information at the top. Then the loan terms, in there you want to check the terms, product, loan type and your loan amount. You want to check if they match your most recent loan estimate. You will also find your interest rate and other terms. In the next two parts, you will find the estimated monthly payment, taxes, insurance, and then closing costs with the cash to close section. All of them you want to check that match your most recent loan estimate.

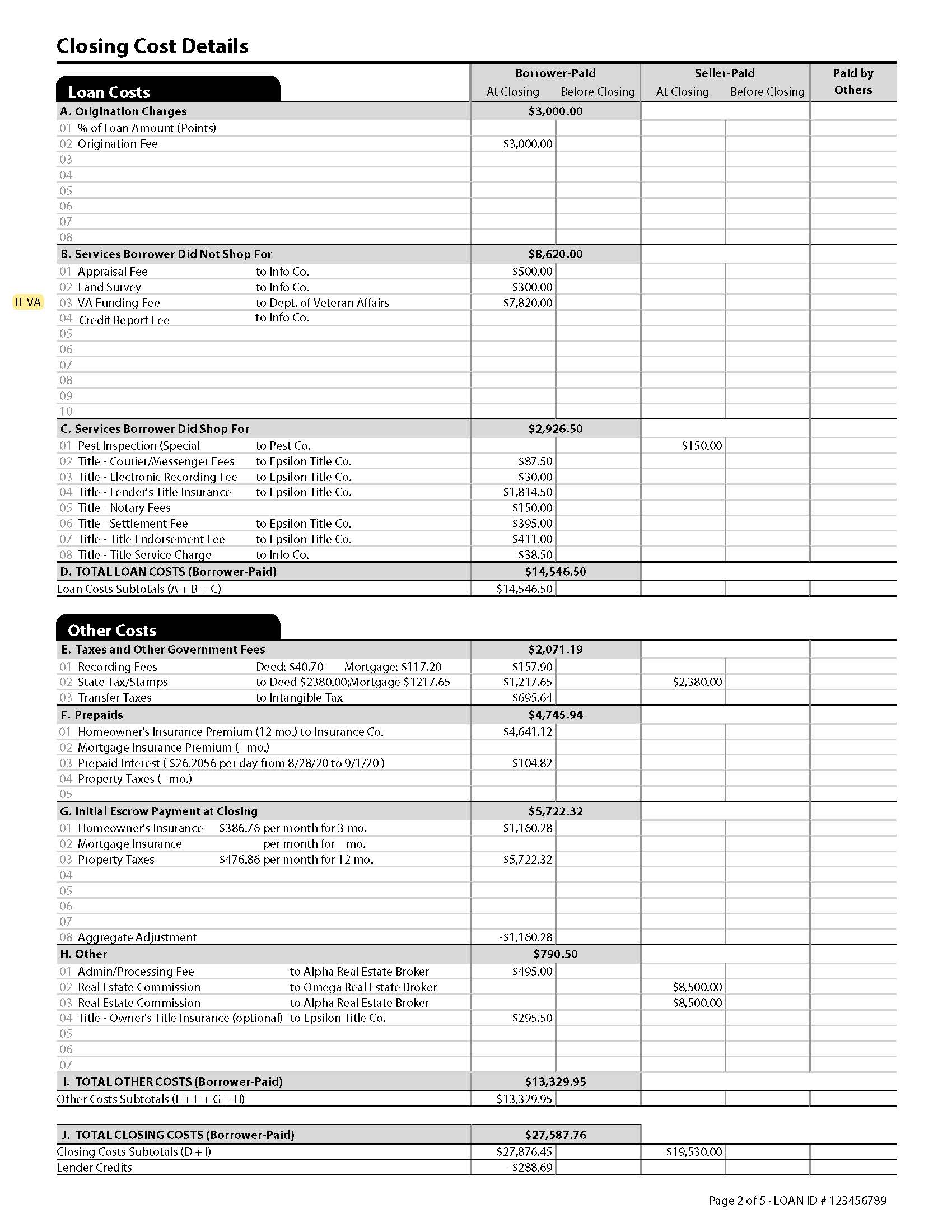

The second page will show you different things but you want to check the services borrower did not and did shop for. They need to be similar to the ones you did not shop for and must match what you agreed to pay for the ones you did shop for.

To see an example of pages 3-5 please CLICK HERE!

For the full explanation of all pages please watch the video to understand more why is so important to understand if you are under contract or you will be soon.

What happen if numbers don’t match?

In general, if any of the previously mentioned parts was changed from your loan estimate or looks unfamiliar, I recommend you to contact your lender and ask for clarification. If there are errors in the closing disclosure, the document may need to be redone — which could delay the closing date. That is why you should contact your lender immediately.

What happen if numbers do match?

If the Closing Disclosure meets your expectations, then you are clear to close. However, you need to sign all the paperwork at closing for the loan become official. Meaning, things can change before the loan settlement. To tell you more, there are actually at least 6 ways to sabotage a mortgage approval, including a job or compensation, making a large purchase, and even a change in your credit. So you absolutely don’t want to do anything of that, you want to close on your home, right?

Don’t hesitate to contact me if you are interested to know more about the home buying process or you have questions about the process.

Also, If you are thinking about buying or selling in Miami, CLICK HERE or you can call me at 786-376-2398.

To know a little more about this wonderful city, I invite you to subscribe to my weekly recap NEWSLETTER. Every week I publish interesting information about Miami, FL and other things that will be very useful for you.

Subscribe to my YouTube Channel: SUBSCRIBE!

Sharon Colón

Your Favorite Real Estate Agent in Miami

Home Miami Realtors

786-376-2398

[email protected]

www.sharoncolonre.com